August 1981 is the last time the Yield Curve Inversion was higher than today. The two-year is yielding 4.7%, astoundingly high. The inversion is a very strong signal of recession.

Thursday, November 3, 2022

10 yr-2 yr Treasuries, -0.51 Yield Curve Inversion

Tuesday, November 1, 2022

Real Weekly Earnings of Production & Nonsupervisory Employees, Ex-Gov

Blue-collar workers, with <2 years under Biden, have seen the steepest declines to inflation-adjusted pay. Only Ford & Carter have seen similar catastrophe:

Thursday, October 27, 2022

Real story about +2.6% GDP in Q3, improved from -0.6% in Q2

Wednesday, October 26, 2022

Friday, October 21, 2022

Thursday, October 13, 2022

Thursday, October 6, 2022

JP Morgan Global Manufacturing PMI – fell to 49.8

JP Morgan Global Manufacturing PMI – fell to 49.8 in September, down from 50.3 in August. This is the first time that the headline PMI has posted below the neutral 50.0 mark since June 2020

Saturday, September 3, 2022

One Can’t Say the US Fed is Hawkish

The Fed's Balance Sheet is nearly $9 Trillion. Quantitative Tightening is talking down the Balance Sheet $100 Billion a month. At this rate it will take ~5 years to normalize the Balance Sheet. With a looming disaster this large (including $30 Trillion in Government Debt) it is hard to say what the right thing is to do:

Friday, September 2, 2022

Friday, June 3, 2022

Thursday, May 12, 2022

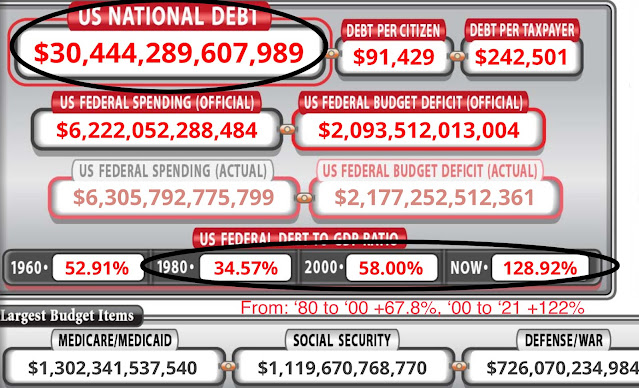

US National Debt is > $30T & Growing Exponentially! Big Government Ruins

The US National Debt rate has increased about doubled in the past 20 years. Even a child understands you have to live within your means, but our Federal Government has taken us from being Freedom Fighters to unstable Debt-Enslaved Nation:

Sunday, May 1, 2022

Thursday, April 28, 2022

Dollar Index $DXY is now strongest it has been since just after the Tech Bubble pop in the early 2000s

Friday, April 22, 2022

Wednesday, January 19, 2022

Tuesday, January 11, 2022

McClellan Summation Index for Staples Near Decade High, Bad for S&P 500

Friday, December 3, 2021

Some Optimism In the November 2021 Labor Report

210,000 jobs were added in November, far short of the half million estimate, however the unemployment rate came down to 4.2%, better yet the labor force participation rate Rose to 61.8%, still far short of the 63.3% rate pre-pandemic: